Understanding "Perils" in Home Insurance

Disclaimer: The content on our blog is intended for general informational and educational purposes only and should not be considered a substitute for professional advice. Insurance needs vary widely, and because insurance companies and policies differ, readers should consult with their insurance agent for personalized guidance. While we strive for accuracy and regularly update our content, we cannot guarantee its completeness or timeliness. HonestFlow is not responsible for any actions taken on insurance policies based on the information provided on our blog.

Understanding "Perils" in Home Insurance

In home insurance, a covered "peril" is a specific risk or event that your policy covers, such as fire, theft, or natural disasters. Each home insurance policy has its own list of perils it covers, and policyholders should be aware of what perils their home insurance policy covers and doesn’t cover. This blog will explore the types of home insurance perils, analyze how different home insurance policies address them, and how HonestFlow can help you find a policy that meets your insurance needs.

Named vs. Open Perils

In home insurance, coverage is often provided on a "named-peril" or "open-peril" basis. Generally speaking, an insurance policy that covers "named-perils" will specifically list which risks it covers. These policies will only cover risks that are specifically named, excluding any risks that are not listed. Conversely, open peril policies cover most risks, except for those explicitly excluded. Open peril coverage typically offers more coverage than named-perils, as it covers a broader scope of risks.

For example: A typical HO3 Special Form Home Insurance policy may provide dwelling coverage on an open peril basis and personal property coverage on a named-peril basis. In this example, dwelling coverage (Coverage A) would be covered for all perils except those that are specifically excluded. For personal property coverage (Coverage C), coverage only applies to the perils listed on the policy.

Why Does This Matter?

Home insurance policies offering open-peril coverage are typically more comprehensive than policies that offer named-peril coverage. This is important to consider when shopping for home insurance because policies that have limited coverage of perils are typically cheaper than policies with comprehensive coverage of perils. If you receive a cheaper insurance quote with similar coverage limits, it’s essential to evaluate the type of home insurance policy and the level of peril coverage it provides. Overlooking this detail might result in buying a policy that seems similar but offers less protection due to limited peril coverage. The next section will highlight different home insurance policies and the general peril coverage they include.

Types of Peril Coverage in Home Insurance

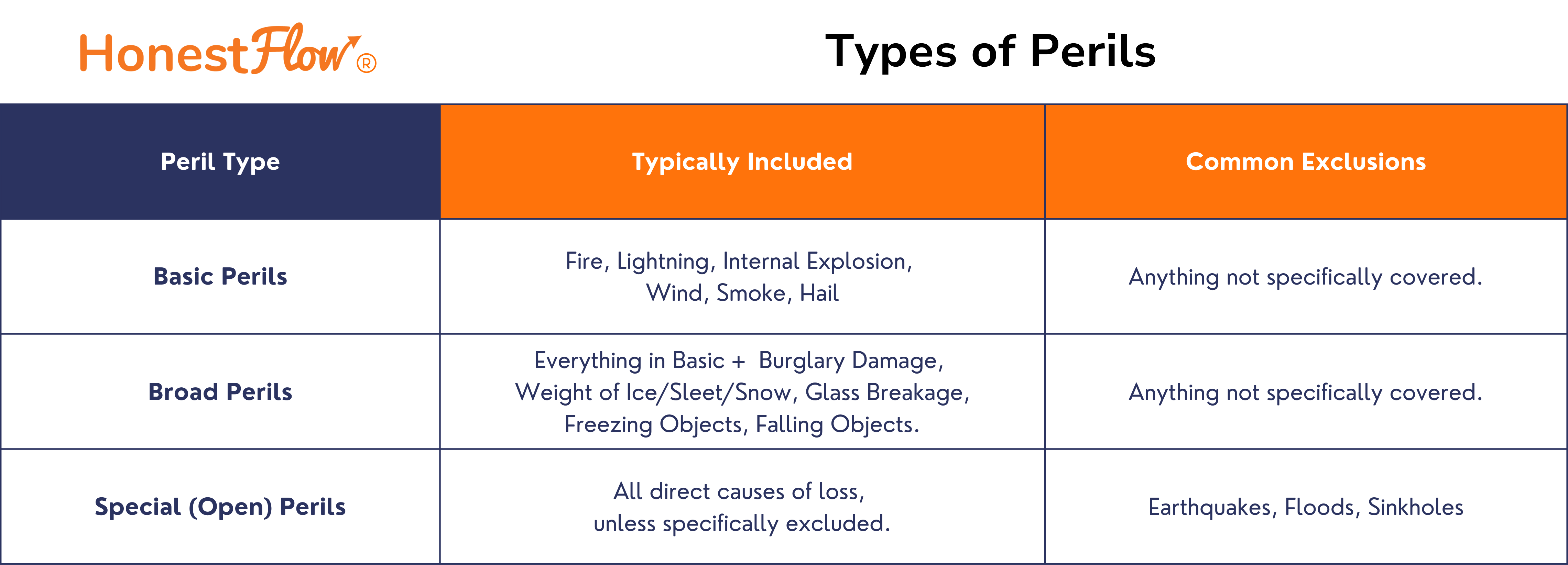

Several home insurance policy forms are available, and choosing the right one depends on the type of insurance you need and the level of coverage you desire. HonestFlow recommends ests working with insurance agents to evaluate suitable coverage options and to determine the appropriate home insurance policy type for your needs. For the purpose of this blog, we’ll look specifically at the differences in home insurance policies by the level of peril coverage they offer. When classifying how many perils a home insurance policy covers, the insurance world generally buckets peril coverage into three categories: Basic, Broad, and Special.

This graphic offers a general overview of home insurance policy forms and the perils they cover. Coverage specifics, including the types and extent of perils covered, can vary widely based on the insurance company, individual policy, and geographical location. The information provided is for general informational purposes only and does not constitute legal or insurance advice. For detailed and personalized information about your specific insurance policies, please meet with your dedicated insurance agent.

Basic Form Coverage (Named Perils): Includes a limited number of named perils listed explicitly in the policy. If a peril isn't listed, it's not covered.

Broad Form Coverage (Named Perils): Covers a more comprehensive range of named perils than the Basic Form and typically includes everything in the Basic Form plus additional risks.

Special Form Coverage (Open Perils): Covers all perils except those explicitly excluded in the policy. This is the most comprehensive coverage form.

Home Insurance Policy Forms (HO1 - HO8)

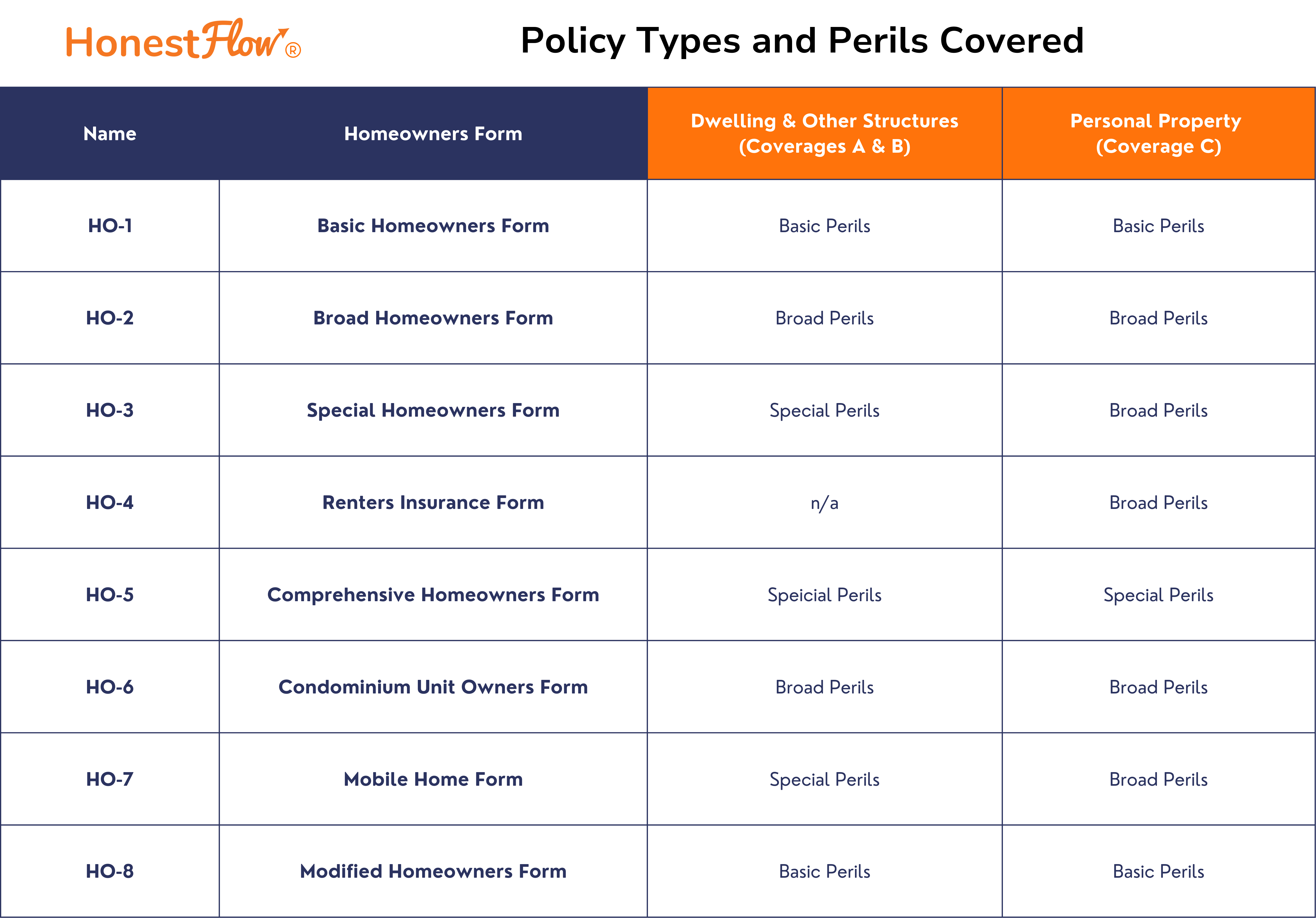

Each home insurance form (HO1 through HO8) offers varying levels of protection and suits different types of properties and homeowner needs. Here’s a brief overview of the different home insurance policies and the perils they cover:

This graphic offers a general overview of common home insurance policy types and the perils they cover. Coverage specifics, including the types and extent of perils covered, can vary widely based on the insurance company, individual policy, and geographical location. The information provided is for general informational purposes only and does not constitute legal or insurance advice. For detailed and personalized information about your specific insurance policies, please meet with your dedicated insurance agent.

HO1: Basic Form Homeowner Policy

Peril Coverage: Basic

Coverage Details: This form offers the most limited coverage, protecting against perils like fire, lightning, and internal explosions. It's important to note that this form is less common and not available in all areas.

HO2: Broad Form Homeowner Policy

Peril Coverage: Broad

Coverage Details: Includes everything in HO1 plus additional coverages like falling objects and damage from the weight of ice, snow, or sleet.

HO3: Special Form Homeowner Policy

Peril Coverage: Special for dwelling and Broad for personal property

Coverage Details: This is a popular form, covering all perils except those specifically excluded for the dwelling. Personal property is typically covered on a broad peril basis.

HO4: Renters Insurance

Peril Coverage: Broad

Coverage Details: Explicitly designed for renters, covering personal property against the same perils as HO2. It does not cover the dwelling itself.

HO5: Comprehensive Form Homeowner Policy

Peril Coverage: Special for both dwelling and personal property

Coverage Details: Provides the most extensive coverage, including open peril coverage for both the structure and personal belongings.

HO6: Condominium Unit Owners Policy

Peril Coverage: Broad

Coverage Details: This policy is tailored for condo owners. It covers personal property and parts of the building owned by the policyholder against broad-form perils. This policy typically does not protect the personal property of tenants.

HO7: Mobile Home Form

Peril Coverage: Can vary (similar to HO3)

Coverage Details: Specifically designed for mobile homes, this form often mirrors the HO3 policy in terms of the perils covered, but it can vary depending on the specifics of the policy and the insurance provider.

HO8: Modified Form

Peril Coverage: Basic (modified coverage)

Coverage Details: Intended for older homes where the cost to rebuild might exceed the market value. It covers a list of named perils similar to HO1 but allows for repair or functional replacement costs.

Key Considerations - Home Insurance Perils

While these forms provide a general framework for understanding perils covered under various home insurance policies, the specific perils covered by a policy can vary by insurance carrier and location. For instance, perils such as hurricanes and tornadoes may not be automatically included in some policies and might require an additional endorsement to cover damages from these specific windstorms. Therefore, discussing with your insurance agent is crucial to ensure that you fully understand what your policy covers and how to address any excluded perils. Here's a few considerations regarding perils on your home insurance policy:

💡 Coverage of perils can vary by geographical location

Some locations may not include the general perils listed in this blog. For example, wind coverage is typically included in most HO3 home insurance policies. However, in Florida, insurance companies may exclude hurricane-related damage unless it is specifically endorsed on the policy. This can also occur in other regions for various destructive risks such as wildfires, hail, and tornadoes.

💡 Coverage of perils can vary by home insurance company

One home insurance company may cover a more comprehensive list of perils than another. For example, if companies A and B both offer an HO3 Special Form policy, company A might include more peril coverage than company B. Working with a dedicated agent can help you confirm which perils are covered by your home insurance policy.

💡 Confirm with your agent about specific peril coverage on your policy

We might sound like a broken record, but discovering too late that your home insurance doesn’t cover certain damages can be a costly mistake. To fully understand what perils your policy covers, it’s best to consult with your dedicated insurance agent. They can clarify which perils are included in your current policy and highlight differences in coverage with other available options.

Finding Your Right Home Insurance Policy

Selecting the appropriate home insurance policy is a pivotal aspect of home insurance shopping, as the home insurance policy will determine the level of risks (perils) it covers. As this blog highlighted general differences in home insurance policies by peril coverage, it's important to note that insurance companies may have varying perils covered for their specific home insurance policies. If you’re in the market for home insurance or looking for more information about different home insurance policies, HonestFlow offers a quick and transparent quoting process to help you find professional home insurance guidance!

Solutions with HonestFlow:

With the various home insurance policies available, and the many nuances of coverage between home insurance companies, HonestFlow suggests connecting with dedicated agents who can guide insurance shoppers to find their best policy options. In addition to connecting shoppers with verified agents, here are a few benefits of requesting home insurance quotes with HonestFlow:

Efficient Quoting: Our quoting flow is designed to pinpoint specific questions to help our verified agents evaluate your best insurance options. No more filling out piles of paperwork; just take a few minutes to answer questions about your insurance needs.

Your Preferences: HonestFlow shoppers decide how many agents to engage with, empowering shoppers to have transparency and control over their insurance journey.

Shopping Tools: The HonestFlow team developed unbiased insurance guides to help navigate coverage options with insurance agents. These are provided exclusively to HonestFlow shoppers after requesting a quote.

Whether you're navigating the insurance market for the first time or seeking better options, request home insurance quotes with HonestFlow!

©️ 2024 HonestFlow LLC. All Rights Reserved