Understanding "Deductibles" in Home Insurance

Disclaimer: The content on our blog is intended for general informational and educational purposes only and should not be considered a substitute for professional advice. Insurance needs vary widely, and because insurance companies and policies differ, readers should consult with their insurance agent for personalized guidance. While we strive for accuracy and regularly update our content, we cannot guarantee its completeness or timeliness. HonestFlow is not responsible for any actions taken on insurance policies based on the information provided on our blog.

Understanding "Deductibles" in Home Insurance

Home insurance is a crucial aspect of homeownership, offering financial protection against risks such as damage and theft. A vital element of any home insurance policy is the deductible. Unfortunately, some homeowners realize their deductible responsibilities at the time of a claim, which can lead to unexpected financial strain. This blog will discuss home insurance deductibles, explaining their types, functionality, and the factors to consider when choosing them.

What are Home Insurance Deductibles?

For most home insurance claims, a deductible is the amount you pay out-of-pocket before your insurance policy starts to cover the cost of a claim. It represents your share of the financial risk in insuring your home. For a general example, if your deductible is $1,000 and you file a claim for $5,000 in covered damages, you'll pay the first $1,000 (deductible), and your insurance will cover the remaining $4,000. Deductibles are fundamental to your insurance policy because they directly affect your premiums and financial responsibility when filing claims.

How Deductibles Affect Your Insurance Premiums

Deductibles and premiums have an inverse relationship. Generally, the higher your deductible, the lower your premium. Opting for a higher deductible means you're taking on more financial responsibility if a claim occurs, which can lower your overall home insurance premium. Conversely, selecting a lower deductible usually increases the premium. To illustrate the relationship between deductibles and premiums, let’s look at a hypothetical example of how different deductibles can influence home insurance premiums.

This graphic offers a general overview of common home insurance deductibles. Coverage specifics, including the types and extent of deductibles can vary widely based on the insurance company, individual policy, and geographical location. The information provided is for general informational purposes only and does not constitute legal or insurance advice. For detailed and personalized information about your specific insurance policies, please meet with your dedicated insurance agent.

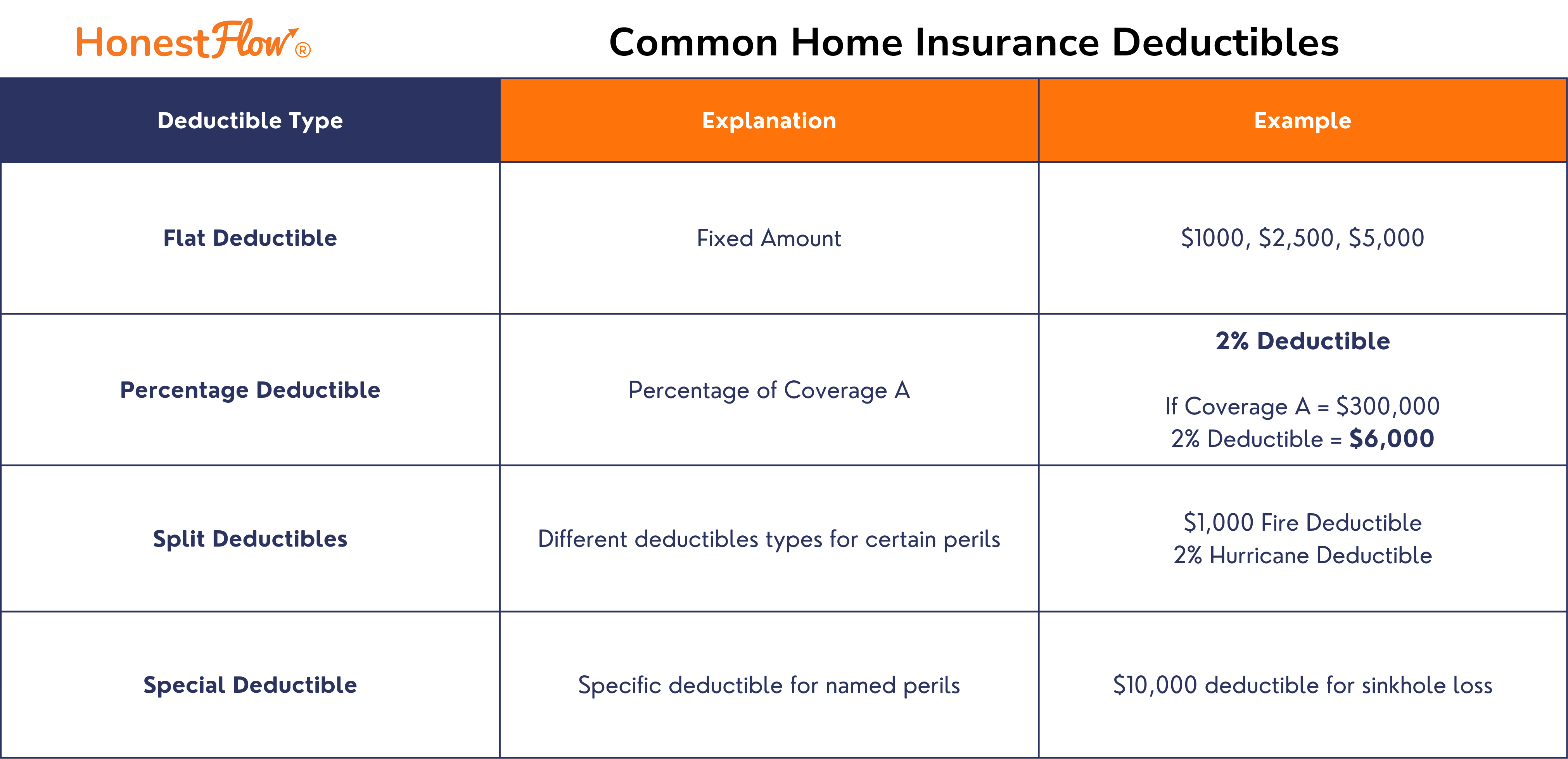

Types of Home Insurance Deductibles

Deductibles can be a fixed amount (e.g., $1,000) or a percentage of your Coverage A limit, which pertains to your dwelling's structure. For instance, a 2% deductible on a policy with $300,000 in Coverage A would equate to a $6,000 deductible. It's crucial to understand the exact amount you're responsible for in the event of a claim.

This graphic offers a general overview of common home insurance deductibles. Coverage specifics, including the types and extent of deductibles can vary widely based on the insurance company, individual policy, and geographical location. The information provided is for general informational purposes only and does not constitute legal or insurance advice. For detailed and personalized information about your specific insurance policies, please meet with your dedicated insurance agent.

Flat Deductible: A fixed dollar amount, such as $500 or $1,000. This is the most common type of deductible.

Percentage-Based Deductible: Calculated as a percentage of your Coverage A limit. For example, a 2% deductible for a policy with a $300,000 Coverage A limit would be $6,000.

Split Deductible: Different deductibles apply to different types of claims. For instance, a policy may have a standard (All Other Perils) deductible and a different deductible specific to windstorm perils.

Special Deductibles: These deductibles are typically associated with specific named-perils. Examples may include sinkhole, earthquake, hurricane, and wildfire deductibles. These deductibles may be higher given the associated risk of covering these destructive perils.

Common Misconceptions - Deductibles

"I paid my premium; I don’t have to pay anything else." In most cases, insurance companies require both a deductible and a premium payment to cover claims. Understanding your deductible is crucial to planning effectively for a claim.

"Deductibles are always required for claims." While most coverages require a deductible at the time of a claim, some, like Loss of Use (Coverage D), Personal Liability (Coverage E), and Medical Payments (Coverage F), typically do not require deductibles. Always verify with your insurance agent about how deductibles apply to your policy.

"Select the highest deductible for maximum savings." Increasing deductibles can reduce insurance premiums, but it’s not a reasonable solution for everyone. Ensure the deductible amount is affordable in the event of a claim. Higher deductibles might cost more in the long run if a claim is filed soon after the policy is initiated.

🔍 Which Deductible is Best?

Each insurance company offers a variety of deductible options, highlighting the importance of shopping for insurance quotes. Exploring deductible options from different insurers enables you to identify a deductible that aligns with your financial situation and risk preferences. While opting for higher deductibles can result in lower premiums, choosing a deductible you can comfortably afford is crucial. Some insurance shoppers might prefer lower deductibles with higher premiums to minimize out-of-pocket costs at the time of a claim. Every homeowner's financial circumstances and risk tolerance are distinct, underscoring the personalized nature of selecting the right deductible.

✅ Solutions with HonestFlow

Shopping for insurance can be challenging; that’s why HonestFlow created a better way to shop for home insurance. Our quoting flow connects insurance shoppers with verified insurance agents who help shoppers find their best deductible options. HonestFlow shoppers decide how many agents to receive quotes from, providing a personalized and controlled shopping experience. Furthermore, HonestFlow shoppers have access to our unbiased resources, including our "Questions to Consider" guide, which helps shoppers identify coverage options with their agents. If you're in the market for home insurance, experience a better way to shop for home insurance with HonestFlow!

Questions to Consider - Home Insurance Deductibles

Below are questions you may consider asking your insurance agent regarding home insurance deductibles. Some of these examples are included in our “Questions to Consider” guide, along with other important home insurance questions. If you're in the market for home insurance, request home insurance quotes with HonestFlow and receive our "Questions to Consider" guide!

1. What deductible options are available for my policy?

Understanding the range of deductible options helps you evaluate which one fits your financial situation and risk tolerance.

2. How does changing the deductible affect my premium?

Higher deductibles typically result in lower premiums, but it’s important to know the specific impact on your policy to make an informed decision.

3. Do different deductibles apply for different types of claims?

Some policies have separate deductibles for specific perils, such as hurricanes or earthquakes. This means the deductible for these events can differ from your standard deductible.

4. Do any coverage options not require a deductible?

Certain coverages, such as Personal Liability or Loss of Use, typically do not require a deductible. However, it's best to confirm this with your agent.

5. What is the actual dollar amount for my deductible?

Deductibles may be a fixed dollar amount or a percentage of your dwelling coverage. Understanding this is crucial to know your exact out-of-pocket costs in a claim.

©️ 2024 HonestFlow LLC. All Rights Reserved